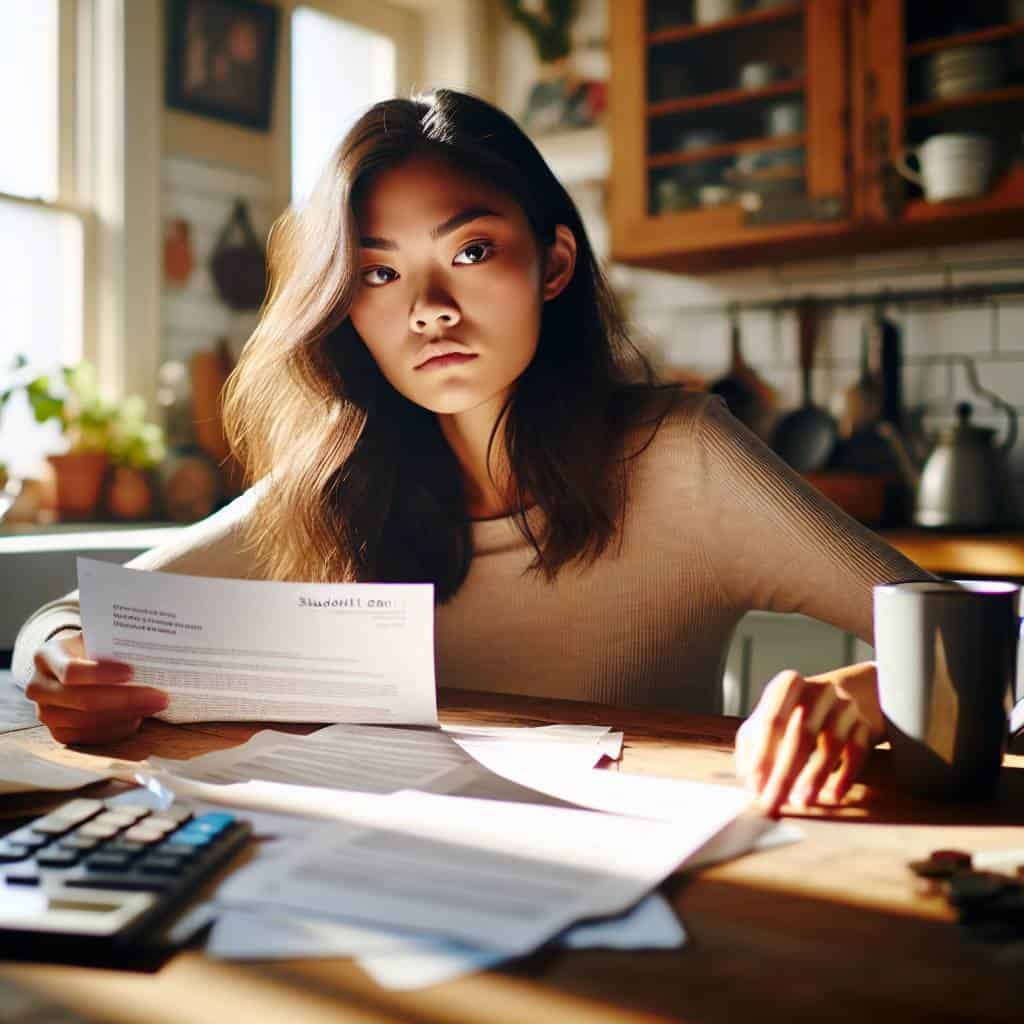

I’ll never forget the day I realized my student loans were like a barnacle on the hull of my life’s ship. There I was, sipping on a cup of coffee that cost more than my lunch, when a letter from my lender landed on the kitchen table with a thud. It was like the universe decided to remind me of my financial shackles. And let me tell you, the interest was growing faster than the weeds in my backyard. That’s when it hit me—sitting around hoping for a windfall wasn’t going to cut it. I had to grab this beast by the horns and wrestle it into submission.

So, here’s the deal. I’m going to lay out a roadmap for anyone ready to declare war on their student loans. We’ll dive into repayment strategies that go beyond the usual spiel, talk about refinancing like it’s a secret weapon, and explore the art of making extra payments without living on ramen. Plus, a peek into the elusive world of loan forgiveness—because sometimes, just sometimes, the system throws you a bone. Stick with me, and we’ll turn this debt mountain into a molehill.

Table of Contents

- The Great Escape: Outsmarting Your Student Loan Nightmare

- Refinancing Roulette: The Game of Interest Rates

- The Art of the Sneaky Extra Payment

- Crack the Shackles: Your Roadmap to Student Loan Freedom

- Break Free from the Student Loan Shackles

- The Debt Escape Route

- Student Loan Liberation: Your Burning Questions Answered

- The Final Stretch: My Journey to Debt Freedom

The Great Escape: Outsmarting Your Student Loan Nightmare

Picture this: you’re standing at the edge of a cliff, and that massive weight strapped to your back—yeah, it’s your student loans. It’s time to outsmart this beast, not just survive it. First, let’s talk strategies. No, not the kind that sounds like a boardroom meeting. I’m talking about real-life, roll-up-your-sleeves plans. Start by mapping out your loan landscape. Know them like you know your annoying neighbor’s daily schedule. Are they federal? Private? Got a mix of both? Once you’ve got that sorted, it’s time to refinance like you’re swapping an old rust bucket for a sleek new ride. Lower interest rates mean more of your hard-earned cash goes to the principal, not the lender’s yacht fund.

Next, put on your battle gear and get aggressive. Extra payments are your secret weapon. Treat them like surprise attacks. Every extra dollar is a step towards freedom. You’ve got a tax return? Bonus at work? Channel those windfalls into your loans like a general rallying troops for a final push. And don’t forget about forgiveness programs. They’re not just myths told around campfires. If you qualify, they can wipe out a chunk of your debt, like a wizard casting a spell. But remember, not everyone gets to wave that magic wand. Do your homework, stay vigilant, and keep your eyes peeled for opportunities like a hawk stalking its prey.

Now, let’s face reality. This isn’t a sprint—it’s a marathon, with obstacles and all. But with persistence and a dash of creativity, you can make your great escape. Outwitting student loan nightmares is possible. It’s about turning the tables, making the system work for you instead of against you. So, grab your metaphorical pickaxe and start chipping away. It’s time to break free.

Refinancing Roulette: The Game of Interest Rates

Picture this: you’re standing at the roulette table, the wheel spinning, the ball bouncing from number to number. That’s what refinancing your student loans can feel like—a dizzying game of chance with interest rates as the high-stakes chips. Now, I’m no stranger to taking risks, but when it comes to your financial future, you want to play smart. Refinancing can be the lifeline that cuts your interest rates down to size, but it can also slap you with a deal that’s worse than what you started with. So, how do you know when to bet and when to walk away?

So, you’re putting every spare cent towards those student loans, and maybe you’re wondering what else you can do to keep your sanity intact while you battle the debt monster. Here’s a thought: blow off some steam by connecting with intriguing people online. It’s not just about the grind; it’s about finding balance. If you find yourself in Berlin, or just wish you were, there’s a chat platform that’s buzzing with life and authenticity. Check out transen berlin, where you can chat with fascinating ladies and maybe find some inspiration or a new perspective to fuel your journey. Because sometimes, a fresh conversation is exactly what you need to keep pushing forward.

Here’s the rub. Banks and lenders are out there, waving promises of lower rates like they’re candy at a parade. But dig a little deeper, and you’ll see that not all deals are what they seem. It’s essential to keep your eyes peeled for the fine print, the hidden fees that lurk beneath the surface. And always—always—compare offers like you’re shopping for the last good piece of pie. Remember, a shiny new rate isn’t worth jack if it means losing flexible repayment options or finding yourself stuck in a worse financial pickle. So, arm yourself with the facts, and don’t let the roulette wheel of refinancing spin you out of control.

The Art of the Sneaky Extra Payment

Let me tell you about a trick that’s got the subtlety of a ninja and the impact of a sledgehammer—sneaky extra payments. Picture this: your student loan is that annoying fly buzzing around your head, and your regular payments are like waving it away. But those sneaky extras? They’re the swatter. Every time you get a little extra cash—birthday money, a bonus, or that five bucks you found in your coat pocket—throw it at your loan like you’re trying to knock it out cold. It doesn’t matter if it’s a few bucks or a couple hundred. Every extra dollar is a step closer to freedom, slicing away at the interest with the precision of a surgeon.

Now, here’s the real kicker. Loan companies don’t exactly roll out the red carpet when you start making extra payments. They’re hoping you’ll stick to the script like everyone else, paying just enough to keep them plump with interest. But we’re not here to play by their rules, right? Call them up, and lay it on the line—tell them those extra payments are to slash the principal, not just pad the interest. It’s your money, your future, and you’re the one holding the reins. So, let’s give them a run for their money, literally.

Crack the Shackles: Your Roadmap to Student Loan Freedom

- First off, let’s face it: refinancing is your friend if the rates are lower than a snake’s belly in a wagon rut.

- Make extra payments whenever you can—think of it like sneaking up on your debt and giving it a swift kick.

- Explore the wild world of loan forgiveness programs, because sometimes, the system does throw you a bone.

- Embrace the avalanche method: tackle the highest interest rate first and watch the dominoes fall.

- Channel every unexpected windfall—birthday cash, tax refunds, found money in the couch—straight into those loans.

Break Free from the Student Loan Shackles

Refinance like you’re bartering at a flea market—jump on any deal that shaves off interest and lets you breathe a bit easier.

Turn every extra dollar into a battering ram—attack your principal like it’s the last boss in a video game.

Consider loan forgiveness, but don’t bank on it. It’s like a rare unicorn in the debt forest—nice if you find it, but don’t hold your breath.

The Debt Escape Route

Treat each extra payment like a sledgehammer to your debt shackles. It’s messy, but it’s the only way out of this financial dungeon.

Student Loan Liberation: Your Burning Questions Answered

What’s the quickest way to kick student loans to the curb?

Start treating those loans like a wild beast that needs taming. Every extra dime you can scrape together, throw it at the principal. Cut out the fluff in your budget. No, you don’t need that third latte or the subscription box for gourmet popcorn. Make bi-weekly payments if you can swing it. It’s all about breaking the chain a little faster.

Is refinancing my student loans a smart move or just smoke and mirrors?

Refinancing can be your golden ticket—or just another detour. If you’ve got a solid credit score and a stable income, lowering your interest rate might just save you some serious cash. But watch out for the fine print. You could lose access to federal protections, like income-based repayment plans. Weigh your options like you’re at a crossroads, because you are.

Are there any real chances for loan forgiveness, or is it just a pipe dream?

Loan forgiveness isn’t just a fairy tale, but it’s not a walk in the park either. If you’re in public service or teaching, you might just hit the jackpot—eventually. But remember, the paperwork’s no joke, and the path is long and winding. Keep your eyes on the prize and don’t get lost in the bureaucratic jungle.

The Final Stretch: My Journey to Debt Freedom

As I sit here, sipping on a lukewarm cup of whatever brew I could scrounge up, I’m reminded that the road to freedom from student loans isn’t exactly paved with gold. It’s more like a dirt track, full of potholes and unexpected detours. But every extra payment, every refinancing strategy, felt like a little victory over the beast. Each move was a step closer to reclaiming my life from the loan shackles that once felt like they were welded on for eternity.

Looking back, it’s clear that the journey isn’t just about numbers and payments. It’s about finding those moments of clarity amidst the chaos, where the fog lifts and you see a glimpse of the endgame. The strategies I used weren’t perfect, nor were they always successful at first try. But they were mine. They were the tools I chose to wield in this battle. And while forgiveness might have been a mirage on the horizon, the real prize was realizing that I had the grit to outlast the storm. Here’s to the journey—and to those who are still fighting their way through it. Keep going, because your story is worth it.